south dakota excise tax on vehicles

Vehicles licensed for. Find information about the South Dakota Commission on Gaming laws regulations and the seven types of gaming licenses issued to the general public.

The South Dakota Department of Revenue is required to impose civil penalties on a business who has a clerk who sells alcohol to a minor.

. This page covers the most important aspects of Georgias sales tax with respects to vehicle purchases. For vehicles that are being rented or leased see see taxation of leases and rentals. Georgia collects a 4 state sales tax rate on the purchase of all vehicles.

There is also a local tax of between 2 and 3. Sales Use Tax. Precious Metal Energy Mineral Severance Taxes Conservation Tax.

SDCL 35-2-101 50000 fine for the first violation if the clerk has participated in a training program that is approved by the department.

Federal Excise Taxes Actual And Projected Revenue From Federal General Download Table

Federal Excise Taxes Actual And Projected Revenue From Federal General Download Table

Ultimate Excise Tax Guide Definition Examples State Vs Federal

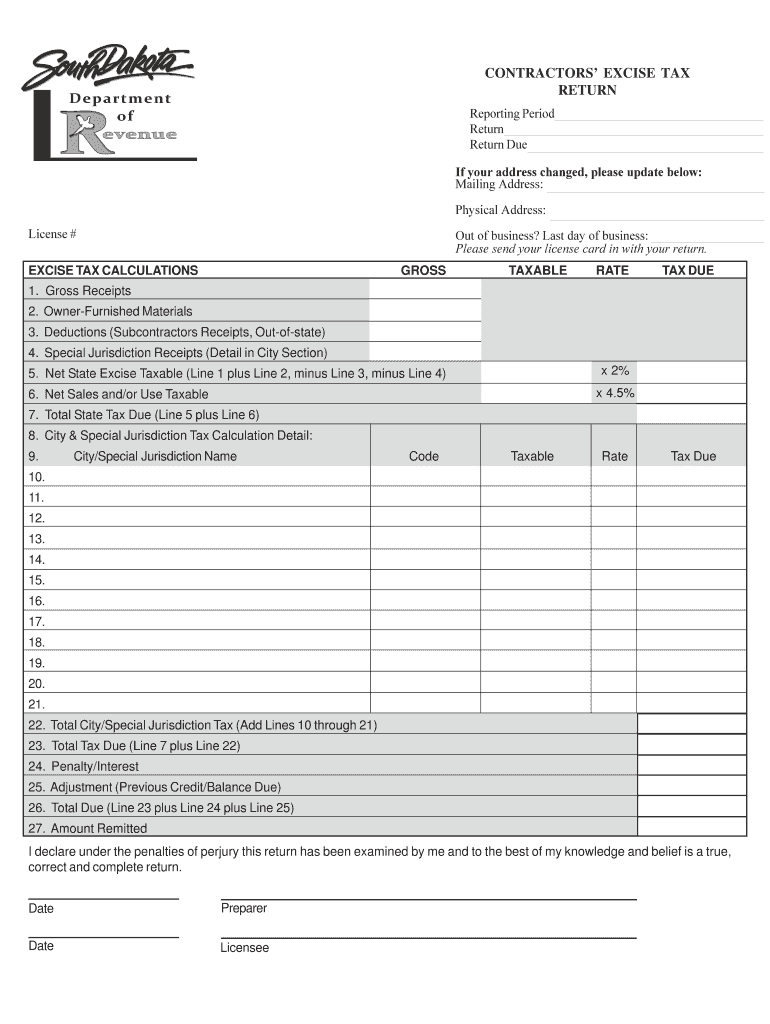

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online Us Legal Forms

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Ultimate Excise Tax Guide Definition Examples State Vs Federal

1928 Chrysler Imperial Series 80 Chrysler Imperial Chrysler Imperial